Categories

What is a UK Reverse Mortgage? | Explained

A reverse mortgage, or lifetime mortgage is one of a range of equity release products that allow those aged 55+ access the money locked into their home.

At Clifton Private Finance, our equity release specialists are here to help you get the reverse mortgage you need, properly UK regulated and designed to help you and your family.

Check Your Eligibility

What’s the Difference Between a Reverse Mortgage and a Lifetime Mortgage?

In the UK, reverse mortgages are called lifetime mortgages. The term 'reverse mortgage' is mainly used in the US, but they work the same way.

You don’t pay back a penny until you pass away or leave the home to live in full-time care, giving you the opportunity to use the money you’ve worked so hard for in a way that suits your later life plans.

How Does a Reverse Mortgage Work?

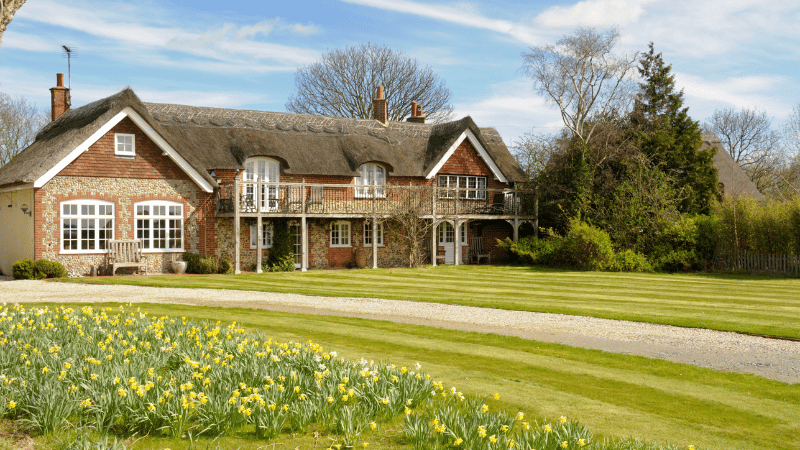

When you’ve paid off your residential mortgage on your home and own it outright, it can often feel as if you’ve spent the majority of your life paying for somewhere to live and even though your house is worth money, all your wealth is locked up in it.

It can feel as if you have to sell your home just to release the money you’ve worked so hard for - a reverse mortgage provides an answer to that problem, giving you the cash you need without losing you your home.

A reverse mortgage is a loan that uses your home as collateral. You are provided a lump sum (usually up to 60% of your house’s market value) for you to use as you see fit. There are no monthly repayments, with the loan being settled in full when you no longer need your home.

This could be because:

- You pass away

- You move into long-term care

- You sell the property

Part of the contract ensures you have a lifetime tenancy, meaning that at no point will you be forced out of your home. The reverse mortgage lender is extremely patient and will wait until the appropriate time for the loan to be repaid.

What Can I Use the Reverse Mortgage For? 6 Examples

In the UK, the money obtained from equity release, which includes a reverse mortgage, is typically free for you to use in any way you see fit. Some of the more common ways our customers have made use of this substantial windfall include:

Helping a younger family member onto the property ladder - Providing a child or grandchild with a no-strings-attached gift that they can use as a deposit on their house is life-changing.

Rather than having them have to wait until your passing to access their inheritance, a reverse mortgage makes the money available immediately, helping them when they need it, rather than years later.

Paying off debt - Sadly, many people reach retirement still saddled with difficult debt, whether that be credit cards, old personal loans, or even the remnants of the original residential mortgage.

A lifetime/reverse mortgage can be used to pay off all your existing debt, allowing you to enjoy your retirement with no financial obligations hanging over your head.

Home improvements - Making your home more up-to-date for your retirement years can ensure you live in the comfort you deserve. People in their later years often suffer from health issues that can make the home layout or arrangement difficult.

Home renovations with an eye to accessibility can make your later years a lot more comfortable. From bathroom refits to accommodate accessibility needs, through to door widening for wheelchairs, your reverse mortgage can help pay for these essential adjustments.

A comfortable retirement - Your pension may not quite be enough to help you enjoy your twilight years. Knowing there’s a comfortable sum of savings behind you to call on should you ever need them can help you relax through your retirement, paying for anything from an unexpected bill through to travel expenses to see your family. Reverse mortgages can give you financial stability.

A large purchase - Perhaps you want a new electric car or to go on that round-the-world holiday you always promised yourself. The money raised through your reverse mortgage is yours to use as you see fit. Splash out - enjoy yourself!

As part of inheritance tax planning - Inheritance tax (IHT) can take a significant chunk of your estate when you pass it on. With help from Clifton Private Finance’s experienced IHT planning partners, a reverse mortgage can be used to mitigate large tax bills.

Speak to a specialist to learn how equity release products can be used to legally and efficiently reorganise your finances to avoid HMRC taking an undue cut.

Related: Equity Release to Reduce Inheritance Tax | Example

Though the options for your reverse mortgage are vast, there are a few conditions for which you cannot use your reverse mortgage:

- Paying for anything illegal - Like all loans, reverse mortgages cannot be used to fund any illegal activity or terrorism.

- For gambling - Strict regulation means restrictions exist regarding reverse mortgages and their use for high stake gambling purposes or to cover gambling debts. In many cases, this definition can mean that reverse mortgages cannot be used for investing in businesses. Discuss your specific needs with a Clifton PF equity release expert to clarify the specifics of use if you are concerned regarding this limitation.

- Lending to others - Reverse mortgages and other equity release products should not be used to provide loans to other third parties.

What Interest Does a Reverse Mortgage Accrue?

Like all loans, a reverse mortgage does increase with interest over time. Because there are no repayments made on a reverse mortgage, interest can grow significantly, with compound interest meaning that the interest added in one year increases the balance and thus increases the interest amount the following year.

However, many factors mitigate this interest to limit the impact and ensure a reverse mortgage is a fair and reasonable product:

No negative equity guarantee - The Equity Release Council (ERC), of which all respected reverse mortgage lenders are a part, ensures a no negative equity guarantee. This means that no matter how much interest a reverse mortgage accrues in its lifetime, the total sum due to the lender can never be greater than the value of the property.

In this way, it is absolutely impossible for your heirs and beneficiaries to be put into a position of owing money to your reverse mortgage lender. The no negative equity guarantee is an important part of the UK commitment to safe borrowing, protecting you and your family from any negative effects of a reverse mortgage.

Property value increase - Property is usually a stable investment in the UK marketplace, with experience showing that property tends to rise in value at a steady rate. In most circumstances, assuming the home is properly cared for, this increase in value outstrips the interest built up by the reverse mortgage.

This has the effect of minimising the impact of accrued interest for your heirs.

Ringfencing - An additional layer of protection is ‘ringfencing’, which means that a portion of the property remains untouched by the reverse mortgage.

For example, it can be set that 20% of the property cannot be affected by the reverse mortgage in any situation. In this case, the no negative equity guarantee is tied to the allowed 80% remaining on the home and no dues can exceed this value.

Ringfencing ensures that a portion of your property is protected, guaranteeing some inheritance, even if interest accrues significantly - but it will also limit the total size of the reverse mortgage that can be initially obtained.

Living in a Home with a Reverse Mortgage

One worry that homeowners have is whether taking out a reverse mortgage will affect their living arrangements. In the most part, no it won’t, though some considerations should be taken into account before agreeing:

The lifetime right to tenancy - The homeowner has a lifetime right to tenancy, meaning they cannot be evicted from the property by the reverse mortgage lender at any time. This is a clear guarantee that you will not ever be forced from your home.

The impact to homeowner spouses - Any spouses who are also legally a homeowner must also be part of the reverse mortgage. This means that they must agree to it and are an equal owner of the money provided by the loan.

The lifetime right to tenancy continues for both homeowners, which means that the reverse mortgage does not have to be paid until neither homeowner remains resident in the property. This protects the surviving spouse fully when the other passes away.

Other residency rights - The tenancy rights are provided only for those specifically named in the reverse mortgage (the homeowners). They do not extend to any other residents. This includes other family members (children, grandchildren, etc.) and also any spouse who is not listed as a homeowner.

Maintaining the property - It is expected that the property be reasonably maintained throughout the mortgage term. In some cases, periodic checks may be made on the property and repairs insisted upon.

In very rare extreme cases where deliberate neglect is seen to be taking place, the reverse mortgage provider could engage in legal action to force repairs. In all cases, however, the no negative equity guarantee protects heirs from any additional costs, no matter the final state of the property at the end of the term.

Paying Back a Reverse Mortgage

A reverse mortgage is repaid through the sale of the property when no listed homeowners remain resident. This is typically because:

- All homeowners have died.

- All homeowners have entered into alternative long-term residential care.

- The property is sold.

The executor of the estate or legally appointed person with financial power of attorney (in the case of residential care) will be required to sell the house at expected market value and the balance of the reverse mortgage repaid in full.

In almost all cases, a reverse mortgage cannot be repaid until the end of the agreed term as detailed above. There are some specialist lenders who offer the flexibility of early repayment, though fees and penalties will apply.

UK Regulations for Reverse Mortgages

All equity release products in the UK are carefully regulated to ensure the decision to enter into an agreement is fully informed and not undertaken under duress.

This means that it is a legal requirement for a solicitor to provide advice and ensure the agreement is suitable before it can be completed.

At Clifton Private Finance, our equity release partners provide impartial advice to assist in getting a reverse mortgage that suits your needs. Our independent status ensures that you are given the support you need to fully understand all the terms of the reverse mortgage as well as being made aware of alternative finance options that may be equally suitable.

An advisor will work with you every step of the way to make the process simple, as well as helping you navigate the complexities of the UK equity release landscape to find you a deal that offers the best rates and most flexibility to suit your needs.