Categories

The Co-Living Trend – Are Adult Dorms Worth Investing in?

Over the past few years, the co-living market has emerged as a focus area for developers, with over £902m funneled into the sector since 2020.

Written by Luka Ball

Adult dorms have exploded in popularity in the past five years, but who are they really designed for, and what role will they play in the future of the rental market? We explore the pros and cons of this unique housing model and dig into what impact they could have on tenants.

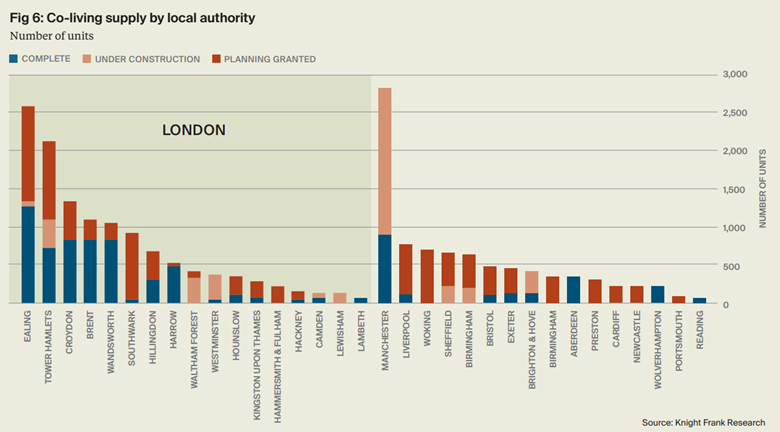

Investment in co-living accommodation reached a record £258m in the first quarter of this year, accounting for a fifth of the build-to-rent market during that period. There are currently 7,540 operational co-living homes in the UK, with an additional 13,483 units either under construction or granted planning permission.

Knight Frank estimates that the potential UK market for co-living includes 1.7 million individuals, but current availability meets just 0.4% of that demand.

Get Development Finance Quotes »

Ending the housing crisis was a key pillar of Labour's manifesto in the General Election this year. Developers and investors are also on the lookout for increasingly inventive ways to provide unique housing for the public.

Co-living developments offer professionally managed, hospitality-led rental homes that prioritise shared amenities over private space. The idea is simple - smaller private units, often studios, are offset by communal facilities such as gyms, co-working offices, and lounges. Proponents argue that the setup caters to young urban professionals looking for affordability and flexibility.

The model has garnered enthusiasm from investors, but its reception among local authorities and residents has been lukewarm. For some, the idea of an adult dorm brings to mind horror stories of student halls for twice the price of a room in a private houseshare.

These adult dorms promise something different. However, critics have voiced concerns that co-living spaces aren’t what they claim to be and, if anything, promote the shrinkification of urban housing by packing multiple adults into smaller spaces for the same price as a one-bed flat.

The response from investors is this: what you give up in space, you get back in amenities. Supporters of the enterprise argue that the overall experience is on par, if not better, than traditional housing options.

See similar: Converting a Pub to Residential Use - How it Works

Understanding Who Adult Dorms Are Made For

It’s all well and good marketing what is essentially a grown-up version of university dorms to graduates in their mid-20s. However, the target age of these tenants ranges from 26-40, which has a few people’s alarm bells ringing.

With the average age of a first-time buyer getting increasingly older, dorms may not necessarily be the right answer for individuals in their 30s and 40s.

In the face of the cost of living crisis, it has become more common for millennials to put off having children. In the UK, the average age at which individuals become parents is 30 for women and 33 for men.

Over a third (37%) of adults plan to remain childless, but nearly half (45%) hope to have children or are open to the idea of having a family.

For individuals that fall into this category, living in a dorm or shared living space would hardly make planning for a family any easier, and with a limited housing stock, it may be their only option.

It’s worth asking who these living set-ups are really designed for and take this into account with the pricing. Realistically, a 38-year-old executive may not have a lot in common with a 26-year-old graduate, which may not lead to the harmonious new-age community that investors are promoting.

Related: How Commercial to Residential Conversions Work

Get Development Finance Quotes »

Providing Housing to Young People

These spaces could still serve as a functional next step for many young professionals without the means or the desire to live alone, while offering independence and privacy. And a sleek new-build and trendy interior could certainly provide a pleasant living environment for those prioritising connection and relationships over independent living.

In South London, Folk’s Sunday Mills co-living scheme demonstrates the model’s appeal. The development let 315 beds in just four months, offering tenants shared amenities like gyms and private dining areas.

The City of London Corporation has also embraced the concept, approving a co-living development opposite the Barbican Estate. The project will replace office space with 174 rental units and communal areas, accompanied by an £8.5m contribution toward off-site affordable housing.

Source: Knight Frank

Overcoming the Red Tape

Not all projects enjoy such smooth sailing. In Hemel Hempstead, a plan to redevelop a derelict gasworks into nearly 500 homes, including co-living units, was blocked by the local council despite a recommendation for approval by its own planning department.

Prime Minister Keir Starmer has pledged to address such obstacles, maintaining a commitment to streamlining planning processes.

Whatever side of the fence you may fall on, if we zoom out, the sudden burst of interest in co-living apartments shows a bigger trend in UK development.

In the past decade, barns and churches have surged in popularity as boutique conversion projects, and buyers seem equally as eager to snap them up. And increasingly, disused pub and office spaces are also being converted into homes.

The needs of the British public have changed, and the housing stock is adapting to cater to that. Are there kinks that need to be ironed out? Certainly.

Legislation needs to be improved, and smaller developers could benefit from government support. But hopefully, these factors will be accommodated by a government that has made many commitments to the housing sector this year.

Furthermore, as the sector grows, it will also test whether the trade-offs inherent to the model - smaller private spaces for greater shared amenities - align with what young professionals truly want.

Development Finance Calculator

To get a better understanding of how development finance quotes are calculated and the rates and fees you'll expect to pay, use our development finance calculator:

Got Your Own Development Project in Mind?

At Clifton Private Finance we have experience sourcing and securing finance for all kinds of developers. From large-scale commercial projects to barn conversions and refurbs, we work with leading banks, private lenders, and specialist institutions across the UK to help get your project off the ground.

We can arrange the most affordable and flexible finance for your project.

We can facilitate a property development loan via a number of specialist lenders across the market – loans of this kind are typically only available from private and specialist development finance lenders.

To see what we can do for you, call us on 0203 900 4322 or book a free consultation below.

.jpg)