The impact of increasing business taxes means that cash flow will be a key factor for businesses in 2025.

Categories

What Challenges Will Businesses Face in 2025?

Whether you’re a newly starting business owner, or a major corporation, 2025 is going to be a major turning point for businesses. So, what should business owners expect to face in 2025?

At Clifton Private Finance, we’re here to offer expert, tailored advice to businesses of any size, whilst also sourcing loans with the most competitive terms for our clients.

Business Asset Disposal Relief and Capital Gains Tax

This year, the Labour government announced changes to Business Asset Disposal Relief (BADR) as part of its 2024 Autumn Budget. As of 2024, BADR reduces capital gains tax on applicable business assets by 10% after selling non-inventory assets, with potential relief reaching up to £1 million.

During a recent discussion with our business finance team, broker James Ellacott shared his insights, stating: “With the business disposal relief increasing from 10-14% in 2025, and later increasing to 18% in 2026, we’re already seeing a lot of management buyouts and buy-ins, which are bound to increase this year.”

Management Buyout

A management buyout is a transaction that involves existing company management purchasing the business from the current owner. This process allows an employee to become an owner, giving them full control over strategic direction and operation.

By quickly performing management buyouts before capital gains tax increases, business owners benefit from selling before facing higher taxes that may greatly impact revenue. Additionally, due to the increased amount of management buyouts, management buy-ins naturally follow.

Potential Growth in the Hotel and Hospitality Sector

According to Hospitality Net; “On a cumulative basis, year-to-date [hotel] investment volumes reached £4.7 billion to the end of Q3 2024 – 181% higher than the same period in 2023.”

The rising intrigue from investors in hotels has seen noticeable impacts on the day-to-day of our business finance brokers who have noted the increasing volume of hotel acquisition finance.

After the COVID-19 pandemic, which left hotels almost entirely without cash flow, the hotel and hospitality sector saw significant financial crises, with lenders growing increasingly concerned about investing in the industry as a whole.

In discussion, our business finance team stressed the risk of hotels to lenders: “Hotels are really high risk, there’s not really a great appetite out in the lending market. Lenders can’t leverage very highly against the asset. Lenders would expect a good equity contribution”.

We’ve handled a multitude of cases where clients have sought hotel financing for purchasing a hotel, our brokers are highly experienced and are more than capable of creating a bespoke funding solution for you.

Read some of our latest case studies to see what we can achieve at Clifton Private Finance:

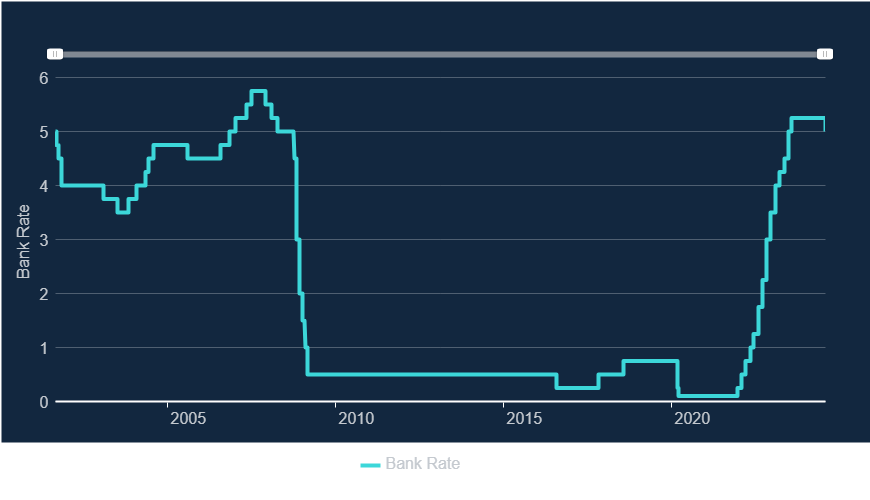

Base Rate: How businesses will be impacted in 2025

Bank of England Official Bank Rate Graph

The impact of the base rate (also known as the Bank Rate), as set by the UK’s central bank, the Bank of England, determines the interest rates across all commercial banks in the UK.

A disadvantage of raising interest rates, however, is that borrowed money, whether it’s a business loan, mortgage loan or otherwise, will also increase with the base rate, costing you considerably more in the long run.

How will base rate affect business finance products in 2025?

Labour’s Autumn Budget in October predicts a short-term boost to the UK’s economy, but according to the BBC’s business report from Tom Espiner; “changes to tax and spending would mean the cost of borrowing would fall more slowly”, which in turn will “push UK inflation”.

Business broker, James Ellacott noted this decline in conversation: “When it comes to The Bank of England’s base rate, the market rate is a lot more cautious in lowering it as they potentially were before Labour’s Autumn Budget, leading to a loss of optimism for it falling as fast as it had been earlier this year.”

Cash flow management in the face of rising costs

Rising costs throughout 2025 are going to cause strain on business owner’s cash flow. Our business brokers have seen a noticeable rise in clients seeking business loans, revolving credit facilities and merchant cash advances to cover costs, especially in businesses that are seasonally affected.

“The cost of running a business is significant”, stated our business brokers, “spare cash is, therefore, harder to earn. We’ll keep seeing enquiries for finance and revolving lines of credit as there’s not as much free available cash.”

If a business is struggling to cover rising taxes, they can seek help from us to cover the costs of VAT and corporate tax, an effective short-term solution to a significant cash flow detractor.

Here are some of the ways we can help:

VAT bridging:

When purchasing a commercial property, businesses can seek support from the 20% VAT charged additionally to the purchase price of the property through a VAT bridging loan.

A loan used solely for covering an upcoming VAT payment, the bridging loan is typically secured against the commercial property and is paid back in a short time frame by the borrower at a highly competitive interest rate.

Alternatively, businesses can split the cost of the quarterly VAT loan for up to 12 months, giving them plenty of time to establish cash flow and secure strong turnover.

What’s more, if you’re using commercial property for taxable services and activities, there’s a strong chance that the VAT you’ve paid exceeds the amount of VAT you’ve charged on your sales during a VAT accounting period. You can therefore reclaim the excess VAT you’ve paid, helping to cover the costs of the VAT bridging loan.

Clifton Private Finance is highly capable of supporting you throughout the VAT loan process, offering a streamlined service with access to a loan within a short timeframe.

Corporation Tax Loan:

When businesses receive corporation tax, which takes 20% of all business profits, it can undoubtedly take a toll on cash flow, leaving less capital for investing in your business.

At Clifton Private Finance, we can allow you greater time to pay your quarterly corporation tax, stretching the cost for three, six, nine, or twelve months. Spreading the payments minimises the immediate impact of corporation tax, giving business owners greater freedom to acquire and maintain new assets to help the business thrive.

Are there any trends in green finance or sustainability-linked loans that will continue in 2025?

In 2024, we’ve seen widespread support from lenders who are keen to support the development of green businesses and projects, we’re likely to see more support from lenders in 2025.

If there’s an element of your business’s development that is green or is adding value to the green space, you can receive up to 100% of financing, which isn’t typically offered by lenders.

This is part of a wider effort from the UK to reach net zero by 2050, and across all industries, regulations are tightening.

Development projects for renewable energy technologies, such as solar-powered farms, wind turbines, and hydroelectric systems are particularly enticing to lenders, not only for their alignment with Environmental, Social, and Governance (ESG) criteria but also for their reputational benefits.

Agriculture has also seen extensive support from lenders which will only grow this year. At Clifton Private Finance, we’re particularly excited to work with farmers and innovators in the agricultural industry, and our agricultural farm finance product is a fantastic, cost-effective solution to cash flow concerns.

This year, we're likely to see development in automated farming, fields such as precision agriculture, which utilises AI to control and minimise water wastage and the use of pesticides are bound to be highly desirable for lenders.

Which sectors or industries will see the most challenges in accessing finance in 2025?

Many industries are bound to face challenges in accessing finance in 2025, but construction companies are likely to continue to face the most difficulties this year.

Rising upfront costs, worker shortages, rising wages, and costly project cycles that require sustained funding are all major contributors to a downturn in the construction industry.

To support the construction industry and other invoice-reliant businesses throughout this difficult time, we offer a range of specialised construction invoice finance products, where we can give you access to capital within 24-48 hours. This immediate cash injection is crucial for covering upfront costs and keeping major projects on track.

What impact will AI have on business finance?

With the introduction of more human-like artificial intelligence, as well as behind-the-scenes automation for business finance brokers, we’re likely to see a much larger pool of clients being sifted at once.

Sole traders and newer companies are likely to find greater difficulty in being accepted for new loans due to a lack of demonstrable creditworthiness as a result of more automated services, but with expert customer service as provided by Clifton Private Finance, the true value of a business can be realised.

Why Choose Clifton Private Finance?

If you’re looking to explore financing options, we’ve got you covered. Contact us for a flexible, pressure-free consultation today, and discover how we can assist your business’s growth and development.

Regardless of if you're working in construction, making your company greener and more environmentally sustainable, or looking for a short-term cash solution to assist in upfront costs, we're here to help.