Categories

How to Find and Download Tax Documents for a UK Mortgage

If you're self-employed and applying for a UK mortgage, you'll need to find and download the right tax documents for your application.

Unlike with a 9-5, you won't have a payslip to use as proof of income when applying for a self-employed mortgage. Instead, lenders analyse your tax documents to get an idea of your earnings and assess your affordability for a mortgage.

Find the Perfect Mortgage

Your mortgage lender will need proof of your income for at least the last two years, and they will usually only accept the following HMRC tax documents:

- SA302 (Tax Calculation)

- Tax Year Overview

Having these documents at hand is important before you make your application, as it can drastically speed up the process. Our guide has clear and easy steps to navigate this essential part of your self-employed mortgage application.

Key Takeaways:

- When you apply for a mortgage, lenders will need proof of your income for at least the last two years.

- This is typically through SA302 (Tax Calculation) and Tax Year Overview documents from HMRC.

- An SA302 shows your earnings and taxes paid for a given tax year, and a Tax Year Overview summarises your tax calculations.

- Both of these documents can be downloaded from your HMRC online account or requested via HMRC’s helpline.

UK Tax Returns: How They're Used in Your Mortgage Application

Most working people in Britain are subject to pay-as-you-earn tax (PAYE), which is deducted from your salary automatically. But if you're self-employed, you'll need to do your taxes manually, and a number of lenders will want to see this to get a clear idea of your financial circumstances.

It's likely you'll be required to provide specific tax documents as part of the application process. These documents help lenders assess your affordability and credit rating and ensure you're paying the correct taxes according to UK laws.

When applying for a mortgage when you're self-employed, lenders will want to look at your net profit over the past two to three years to get an understanding of your income and overall affordability.

If you're unsure where to start or are unfamiliar with the process, we've put together this guide to help you navigate through the various documents you may need and where to obtain them.

This blog post covers the common tax documents required for a UK mortgage, including tax returns and SA302 forms.

We'll also show you how to download and organize these documents so that you can present them to your lender with confidence.

What is an SA302?

An SA302, or tax calculation, is a document that breaks down your earnings for a given tax year based on your Self Assessment for that year.

For mortgage purposes, it proves to a lender how much you have earned and how much tax you paid in a previous year. This assures lenders that you will earn similar amounts in future years, so you will likely be able to keep up with your mortgage repayments.

You can either download a PDF copy through your HMRC online account or request a copy in the post by calling HMRC’s helpline on 0300 200 3310.

It's worth noting that this process can differ if you have more complicated circumstances, such as you're living abroad, applying for a large mortgage, or you're using commission or bonus-based income to raise finance.

In cases like these, your mortgage lender may have more stringent criteria, and you can expect to file additional paperwork and verification of your earnings. You can also expect different criteria if you're applying for a buy to let mortgage.

An advantage of working with a specialist mortgage broker like Clifton Private Finance is that our brokers can process your paperwork for you, negotiate on your behalf, and search the market for the best rates for your circumstances.

What is a Tax Year Overview?

Your tax year overview summarises your tax calculations for a particular tax year and supports your SA302 as evidence of your earnings.

Your mortgage lender will use your tax year overview to cross-reference the information on your SA302, ensuring it is correct and legitimate.

As with your SA302, you can either download a PDF copy through your HMRC online account or request a copy in the post by calling 0300 200 3310.

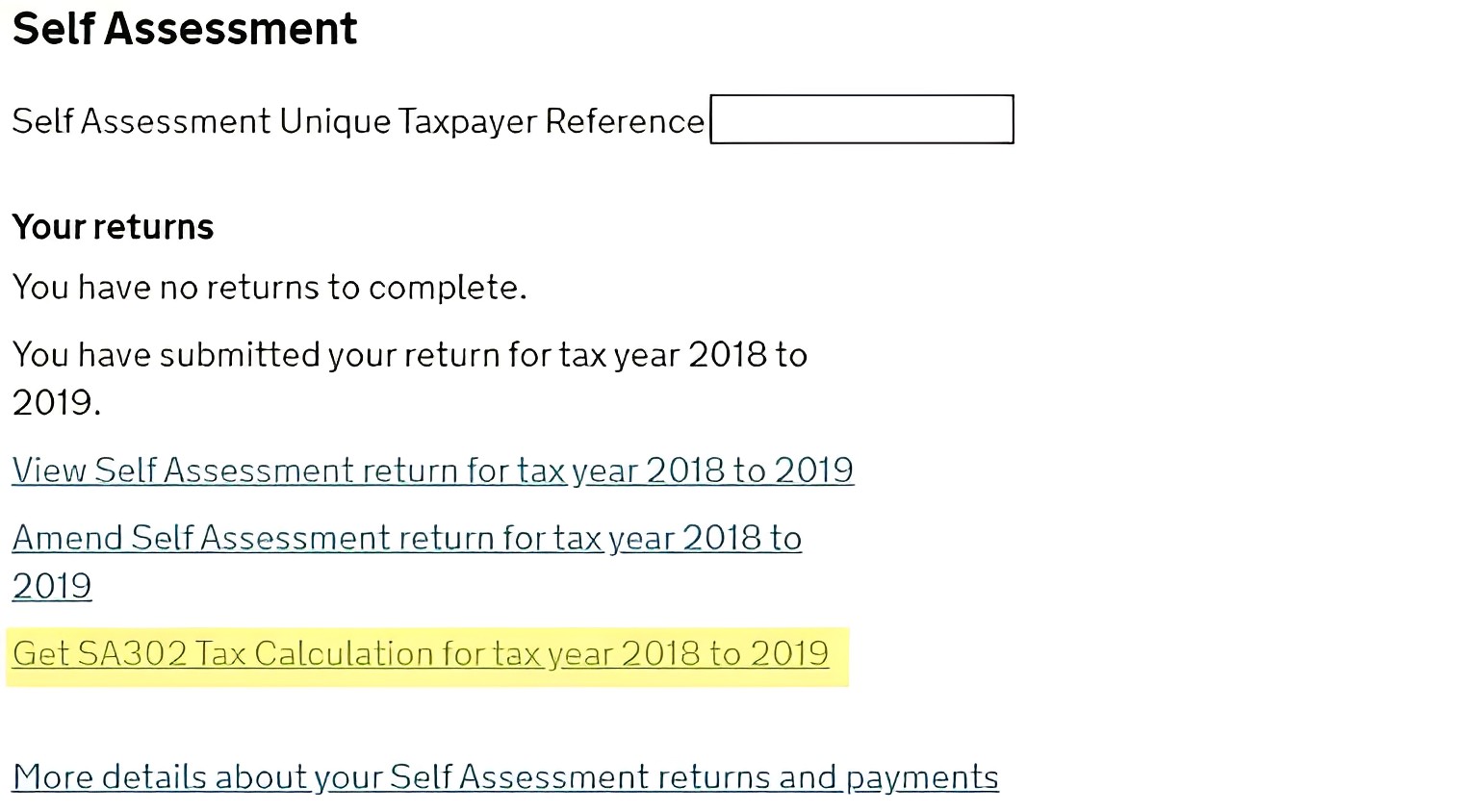

How Do I Download My SA302?

- Log in to your HMRC online account, here

- Click ‘Self Assessment’ - note that you will be taken here automatically if you are only registered for Self Assessment purposes

- Click ‘Get SA302 Tax Calculation', as per the below screenshot:

- Click ‘Continue to your SA302’

- Click ‘View your Calculation’

- Look for the ‘Print this page’ button:

- Depending on your PC, either right-click and 'Save as PDF', or select ‘Save as PDF’ from your printer options drop-down menu and click ‘save’.

- If on mobile, tap to save a copy to your phone’s downloads folder

- Save it to a folder that you can locate easily

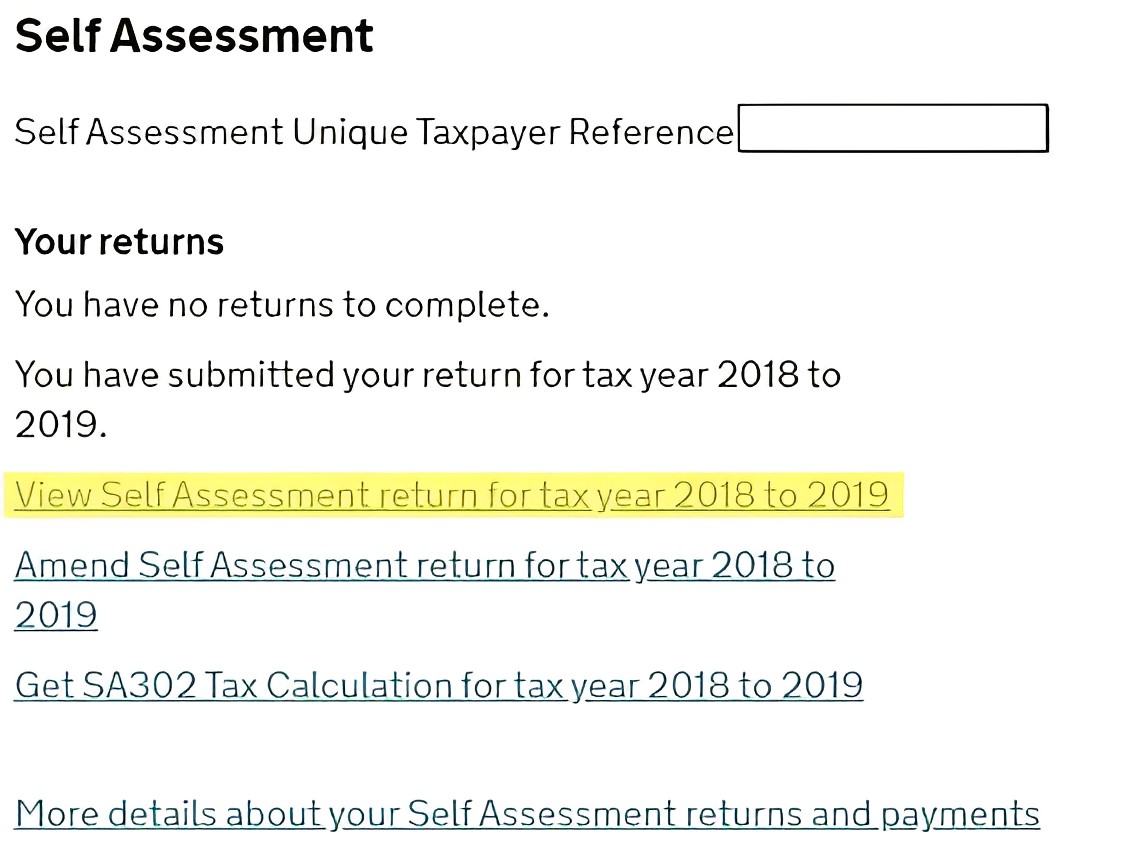

How Do I Download My Tax Year Overview?

- Log in to your HMRC online account, here

- Click ‘Self Assessment’- note that you will be taken here automatically if you are only registered for Self Assessment purposes

- Click ‘View Self Assessment return' as per the below screenshot:

- Choose a tax year from the drop-down menu and click ‘Go’

- Look for the ‘Print this page’ button:

- Depending on your PC, either right-click and 'save as PDF', or select ‘save as PDF’ from your printer options drop-down menu and click ‘save’.

- If on mobile, tap to save a copy to your phone’s downloads folder

- Save it to a folder that you can locate easily

Need more info? Check to our guide on how to prepare your bank statements for your mortgage application.

Need Some Help?

Working with an experienced mortgage broker can simplify the application process and get you access to the best deal on the market. At Clifton Private Finance, we have long-term relationships with high street, private and specialist lenders.

Our team of specialist brokers can give you a clear idea of your options, liaise with lenders on your behalf, and guide you through the paperwork.

We can help with:

- Expat & international mortgages

- High-Value Mortgages

- Complex Income

- Buy-to-let Portfolios

- Commercial Mortgages

Call us at 0203 900 4322 or book below to arrange an in-depth discussion with one of our trusted advisers.