Categories

NEWS: First-Time Buyer Repayments 20% Lower than Rent

A recent Zoopla report has revealed that first-time buyer mortgage repayments in the UK are 20% lower than the cost of rent. The findings come as house price growth has stalled, while rents continue to rise (up 32% over the last five years).

Zoopla analysed the cost of renting vs the cost of buying across 118 postal areas of Great Britain, with the results reveal wide regional variations.

The biggest gaps between mortgage repayments and rental costs are more than 30%, and were found in the following cities:

- Glasgow (-46%, G)

- Newcastle (-34%, NE)

- Edinburgh (-32%, EH)

- Liverpool (-31%, L)

- Cardiff (-31%, CF)

The only region of the UK where it remains cheaper to rent than to buy is the East of England, where buying remains 9% more expensive.

Key Takeaways

- First-time buyer mortgage payments (£1,038 per month) are 20% lower than rents (£1,248 per month)

- The gap is the widest in the North East region, where mortgage repayments are 24% below rents

- Raising a deposit is a significant constraint for first-time buyers, with a 20% deposit costing £27,700 in the North East and £83,400 in London

This follows on from Zoopla research in April 2024, which found that the average homeowner in the UK faces annual mortgage repayments of £11,400. At the time, this was up 60% since 2021, when repayments averaged £7,000 per year. This rise in mortgage costs places financial pressure on homeowners as many anticipate a drop in mortgage rates.

The average household is contending with an additional £4,320 in annual mortgage payments, but the impact is more severe in London and Southern England, where property is more expensive.

In London, homeowners are grappling with an average of £23,000 in annual mortgage payments, up by £7,500 since 2021.

The South East and South West are similarly affected, with annual repayments rising by £6,000 and £5,300, respectively.

In contrast, homeowners in other parts of the country are experiencing less severe increases. In the Midlands, annual mortgage payments have risen by £3,900, while in the North East, the increase is only £2,350.

Read blog: Are Mortgage Rates Going Down?

The Impact of Rising Mortgage Repayments

Mortgage rates have spiked twice since 2022. The first was after the Autumn mini-budget and after the bank rate was increased to 5.25% in August 2023.

These hikes diminished buyers' purchasing power, reduced homeowners' disposable income, and significantly affected the housing market. Sales dropped 23% over 2023, and house prices declined modestly.

In 2025, the Bank of England has reduced the base rate to 4.00%. As a result, we are now seeing mortgage rates below 4% from some lenders, reflecting significant optimism in the market.

The low rates we saw in 2021 are increasingly a thing of the past as more households' fixed-rate deals come to an end. Similarly, many homeowners are downsizing, releasing equity, or relocating to help make ends meet.

Related: Can I Get a Mortgage for 5 or 6 Times My Salary?

What Do the Experts Say?

George Abouzolof

Senior Finance Broker CeMAP

In February 2026, the Bank of England has decided to hold the base rate at 3.75%, following a drop from 4.00% in late 2025. Consecutive drops are very rare, so this comes as no surprise.

Measures announced in the Budget are expected to place some pressure on household spending, which can help ease inflation over time.

Mortgage borrowers may see some lenders increase rates very slightly in the short term, but the Bank of England's stance is to continue cutting the Base Rate through 2026, which will likely ease borrowing rates in the longer term.

Alex Chambers

Senior Private Client Adviser

With the inflation forecast expected to peak at 4% in the latter half of 2025, financial markets expect the Bank of England to cut rates even further in late 2025 or early 2026 - potentially to around 3.75% or 3.5%.

The economy has shown modest growth. Forecasts are at around 1% for the year, but there is a lot of global economic uncertainty at the moment so I would expect any growth to slow.

What the Public Predicted

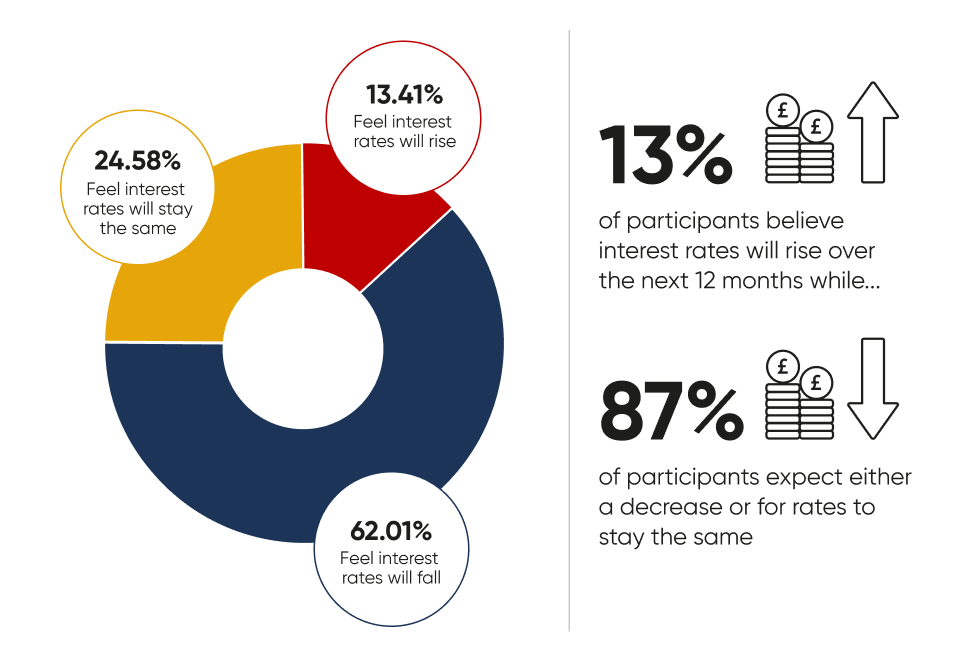

In our 2024 Mortgage Pulse Report, just 13% of participants believed interest rates would rise over the next 12 months, while 87% expected either a decrease or for rates to stay the same.

It's fair to say the majority of respondents were accurate in their assessment.

This sheds some additional light on the fixed or tracker mortgage debate for first-time buyers and those remortgaging in the coming months.

Case study: Read our case study below detailing how we saved our client over £37,000 by switching lenders on their mortgage

What Next?

Amid an elevated cost of living, access to the best rates is more important than ever.

Working with an independent, whole-of-market mortgage broker allows you access to the best rates on the market. A good broker can connect you with a suitable lender and offer expert guidance along the way, ensuring the process is as smooth as possible.

Whether you’re remortgaging, releasing equity, or purchasing a new property, we can accommodate your needs and make sure you get the best deal for your circumstances.

To see what we can do for you, call us at 0203 900 4322 or book a free consultation below.