Categories

Should You Get a Tracker or Fixed Rate Mortgage in 2024?

The Bank of England has announced that it's keeping base rate at 5.25%. We're taking a snapshot of the best rates available on the market today for fixed and tracker mortgage products and see how they compare.

With higher interest rates driving up costs, many are asking what this means for our mortgages in the coming months.

For those looking at buying property or remortgaging, the question at hand is whether a fixed or tracker mortgage is most suitable right now.

We'll go through the pros and cons of fixed rate mortgages compared to trackers, to help you decide what type of mortgage is right for you.

In this guide:

What is a fixed rate mortgage?

How long does a fixed rate mortgage last?

What interest rates can I get?

What happens at the end of my fixed rate mortgage term?

The pros and cons of fixed rate mortgages

The pros and cons of tracker mortgages

Are interest rates going to rise in 2024 and beyond?

- What do the experts say?

How can a Mortgage Broker Help?

What is a fixed rate mortgage?

A fixed mortgage is a mortgage with a guaranteed rate of interest for a specified term.

This means that the interest rate you pay on your loan will not change for the duration of your fixed term.

Get Fixed Rate Mortgage Quotes »

This doesn't mean the entire duration of your entire mortgage - which could be 25 years or more - but just the duration of your current deal.

How long does a fixed rate mortgage last?

You can get fixed rate mortgages for various term lengths, but most are typically 2 year or 5 year fixed terms.

3 year fixed rates are also available from some lenders, and even 10 year fixed rate mortgages became popular in response to prolonged low interest rates in the UK before 2022.

What interest rates can I get?

The rate you get will depend on the mortgage market at the time and the product you take out. Economic factors and other variables affect rates over time, and in turn, this can shape what mortgage type might be best for you.

Here are 3 tables showing some of the best rates on the market for each type, along with some historical rates from the past year for comparison:

March 2023

|

Term |

Product |

Type |

LTV |

Rate |

Subsequent Rate |

Product Fee |

ERC |

|

2 years |

Fixed |

Purchase |

60% |

4.14% |

7.49% |

£999 |

No |

|

5 years |

Fixed |

Remortgage |

60% |

3.89% |

7.49% |

£999 |

Yes |

|

10 years |

Fixed |

Remortgage |

75% |

4.04% |

7.49% |

£999 |

Yes |

September 2023

|

Term |

Product |

Type |

LTV |

Rate |

Subsequent Rate |

Product Fee |

ERC |

|

2 years |

Tracker |

Purchase |

60% |

5.39% |

8.4% |

£999.00 |

No |

|

5 years |

Fixed |

Remortgage |

60% |

5.12% |

6.9% |

£490.00 |

Yes |

|

10 years |

Fixed |

Remortgage |

75% |

4.91% |

6.2% |

£999.00 |

Yes |

March 2024

|

Term

|

Product

|

Type

|

LTV

|

Rate

|

Subsequent Rate

|

Product Fee

|

ERC

|

|

2 years

|

Tracker

|

Purchase

|

60%

|

4.44%

|

8.74%

|

£0

|

No

|

|

5 years

|

Fixed

|

Remortgage

|

60%

|

4.24%

|

7.99%

|

£490.00

|

Yes

|

|

10 years

|

Fixed

|

Remortgage

|

75%

|

4.63%

|

7.99%

|

£999.00

|

Yes

|

See Similar: Is Now the Time to Switch? Major Lender Offers New 5 Year Fix with No ERCs

What happens at the end of my fixed rate mortgage term?

After the duration of your fixed rate term, your mortgage will revert to your mortgage lender’s SVR (Standard Variable Rate). This rate will usually be considerably higher than a fixed or tracker interest rate.

We recommend thinking about either switching your mortgage with your existing lender to a new product or remortgaging to a new lender at this point to avoid paying significantly high-interest rates on an SVR mortgage.

NOTE: If your fixed rate deal is coming to an end in the next 6 months, read this (includes a lesser-known trick to get a better mortgage deal): How early can you switch from a fixed rate mortgage?

What is a Tracker Mortgage?

A tracker mortgage is a mortgage with an interest rate linked to the Bank of England’s base rate.

For example, you could get a tracker mortgage that’s interest rate will always remain at 0.75% above the base rate.

When the base interest rate increases, your monthly mortgage repayments will go up. When the base rate decreases, they’ll go down. The 0.75% difference will stay the same for the duration of your tracker mortgage term.

Related: What is a Green Mortgage, and how do they work?

What are the pros and cons of a fixed rate mortgage?

Pros:

- You know exactly how much your mortgage repayments will be for the duration of your fixed term

- Your mortgage interest rate can't increase during your fixed term, no matter what the base rate does

Cons:

- You could be paying a higher interest rate than a tracker mortgage if the base rate stays low or goes down

- The longer your fixed term, the higher the interest rate you’ll have to pay

What are the pros and cons of a tracker mortgage?

Pros:

- You could pay a cheaper rate than fixed rate products, especially if the base rate falls or stays the same

Cons:

- Your monthly mortgage payments could increase or fluctuate throughout your term

Related: Can you get a mortgage for 5 or 6 times your salary?

Are interest rates going to rise in 2024 and beyond?

There is no way to be certain whether interest rates will continue to rise in the UK. However, while interest rates have been increasing consistently since 2021, many economists believe that rates will eventually drop in the coming years.

Most recently, the Bank of England's base rate was kept at 5.25% to combat inflation, which has now dropped to 6.7%.

The Bank of England is confident that keeping the base rate at 5.25% will cause inflation to drop below 5% before the end of the year. However, ongoing political and economic instability in the UK and worldwide has left many questioning whether there will be further hikes in the short term.

But what about over the next few years? Is it worth fixing for 3-5 years now?

Read blog: Is Switching Lenders Really Worth It?

What do the experts say?

George Abouzolof

Senior Finance Broker CeMAP

BoE have held their nerve and kept base at 5.25% for the 5th time in a row, even though CPI is at 3.4%. Their inflation target is +/- 1% of which we are on the verge of achieving.

Swap rates are on a downward trend too, so we’d expect to see this feed through into lower fixed rate deals soon.

Hopefully, the BoE have learnt from their ultra-low base rate days (circa 0.1%). What they don’t want to do is starve inflation to the point where base rate reductions make little to no difference (known as the zero lower bound of effectiveness).

The next BoE meeting is on the 9th of May, if I were a betting man, I’d suggest we may see the 1st base rate reduction then, assuming CPI has fallen within the target range of which we will know on the 17th of April.

Jonathan Kelly

Mortgage Broker

It’s clear the Bank of England is leaning towards dropping the base rate this year. Most recently, the Monetary Policy Committee voted 8-1, with the majority opting for a pause and the one supporting a decrease. In the previous Bank of England announcement, the committee was split three ways, with two members voting for an increase.

Alongside the inflation rate dropping this year, it looks promising that there will be a reduction at the next review. However, how far and how quickly the base rate falls will be up for debate.

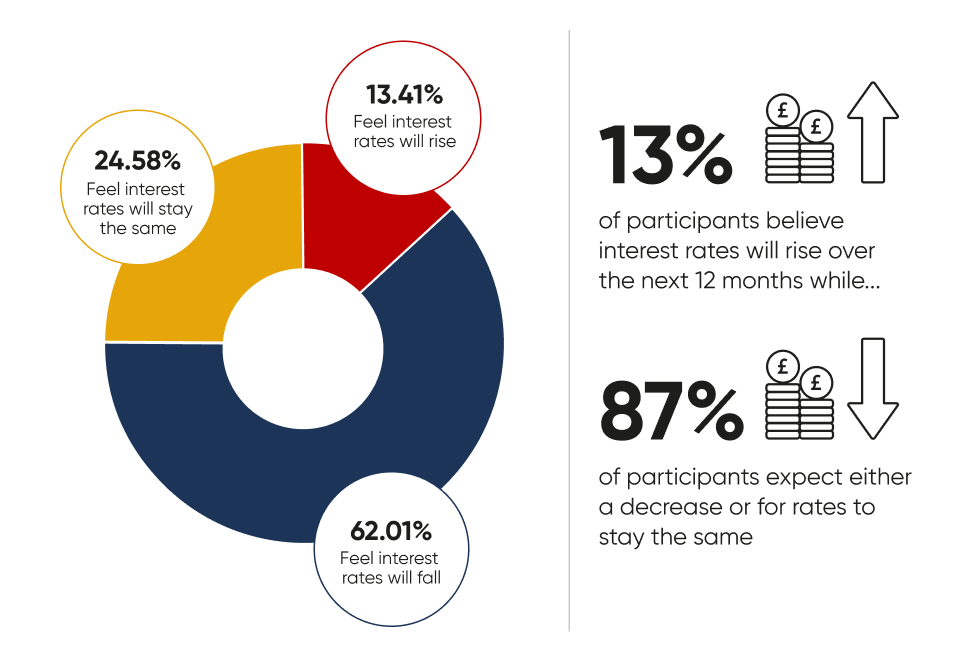

And how about our readers?

150 of our readers completed our interest rates survey in the last few months. Here are the results:

- Just 18% of participants believe interest rates will rise over the next 12 months, while 82% expect either a decrease or for rates to stay the same.

For more on the topic, read our blog: NEWS: Are Mortgage Rates Going Down?

Are you more of a visual learner?

Our video below summarises fixed and tracker mortgages, the pros and cons of each, and how they work to help you decide:

Ask for help

If you’re unsure what kind of product is best for you, having a conversation with one of our trusted mortgage advisers will give you peace of mind that you’re making the right decision.

We can help you decide on the type of mortgage that's right for you. And, we can negotiate the best interest rates with lenders and get access to some fixed rate deals that aren’t available to customers going direct.

Related: Our guide to securing a professional mortgage.

Contact us to arrange a convenient time for an in-depth first discussion with one of our trusted finance brokers and see how we can help:

Call us on 0117 959 5094 to discuss your requirements.

Or you can book a free consultation with one of our expert advisors at a convenient time for you, below.