Categories

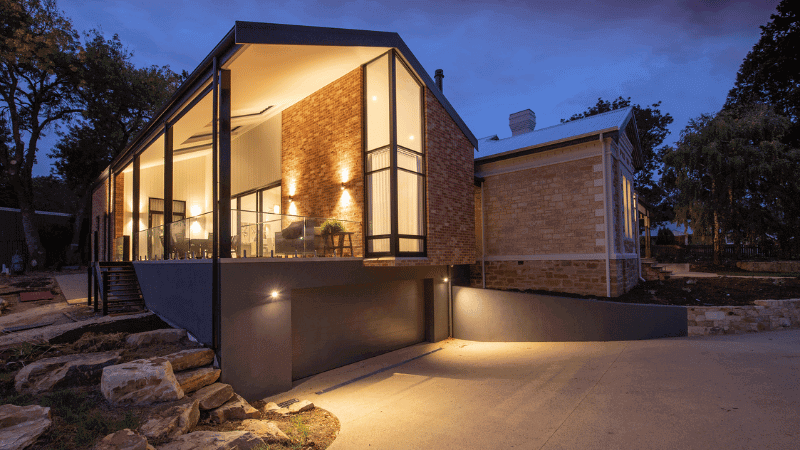

6 Home Improvements That Add the Most Value

We explore the top 6 home improvements that increase value when selling a home. In the property world, the adage "location, location, location" often takes precedence, but savvy homeowners understand that a property's condition and presentation can significantly impact its value. Home renova...

Unlocking Savings: Is switching mortgage lenders really worth it?

Remortgaging every few years can save you thousands over your mortgage term, but new evidence suggests that more people are opting to stay with their current deal instead of exploring other options. In a study conducted by Money Supermarket, an estimated 60% of homeowners are prepared to pay more t...

How To Get Fast Property Auction Finance

Property auction finance must be quick and efficient to keep up with the fast-paced and competitive nature of property auctions. This is why a standard mortgage usually doesn't work for auction finance. They take too long to arrange (typically a number of months), with affordability checks based on...

How to Get a Mixed Use Property Mortgage

A mixed-use mortgage is a finance solution used to fund the purchase of properties that aren't solely commercial or residential. Are you considering buying a shop or office premises with a flat above? Or maybe a one-time pub with a landlord’s accommodation? If so, you’ll need...

NEWS: Are mortgage rates going down? [March 2024]

The Bank of England have held the base rate again at 5.25% in March for at least another 6 weeks, despite speculation of rates going down - but how long will that last? In accordance with Prime Minister Rishi Sunak's pledge to cut inflation in half in 2023, the Bank of England has kept the bas...

Finance Lease | The Complete Guide

Asset finance is one of the most important financial products available for businesses in the UK, providing companies with the ability to expand and develop their businesses with the physical tools that are essential to go about their work. While it comes in multiple forms, for many, the primary li...

Large Interest Only Mortgages - How to Get One

A large interest only mortgage can be a suitable funding solution for individuals with complex income streams and wealth structures. They provide a level of debt flexibility that repayment mortgages can't match. But who are interest-only mortgages for, what are their benefits, and h...

What Deposit Do You Need For A Bridging Loan?

Generally, you'll need a deposit for a bridging loan or equity of at least 20-40%. However, lenders can vary on requirements, and the specifics of your circumstances can change things. So, how exactly does it work, and what are the rules? A lot can depend on the equity used to secure your bri...

Trade Finance | The Complete Guide

Covering a wide range of financial products for businesses that operate internationally, trade finance is an essential component of the financial toolbox for exporters and importers. This guide provides everything you need to know understand trade finance in greater depth, and how to expand yo...

Small Business Financing | The 11 Best Options Compared

Understanding the options available for small business financing is essential to make sure you obtain financial products that help your company, rather than those that put it under additional unwanted pressure. Keeping the money flowing is a constant pressure for small business directors and ...

NEWS: How Much Will My Mortgage Go Up in 2024?

If you're remortgaging in 2024, your mortgage payments could go up by as much as £500 - £1000 a month. Mortgage rates have been dropping, but they're still much higher than they were two years ago. Given these figures, you may wonder how your household will be affected a...

How To Get A Bridging Loan For An HMO

HMO bridging finance - As HMO grow in popularity, we explain how bridging loans can be used to convert a property to an HMO. Landlords are increasingly focusing on Houses of Multiple Occupation (HMO) to increase their ROI. One of the advantages of having an HMO over a regular buy to let is that yo...

How To Get a Loan for an Unmortgageable House

You can get finance to buy an unmortgageable house - but not necessarily via the traditional 'mortgage' route... Bargain-hunting property investors love unmortgageable properties. Packed with potential: competing buyers are scared off by the difficulties in securing finance. But how can you e...

How to Get a Joint Mortgage with a Non-UK National Partner or Spouse

Getting a joint mortgage where one partner is not a UK national can be challenging. We have a strong track record in matching international clients with the lending they need. This guide explains why it can be difficult and what you can do to improve your chances. Skip to: Why Is it Difficult? 3 ...

Is a 1% Deposit Mortgage Worth It? | 99 LTV Mortgage

A new low loan-to-value mortgage product could make mortgages more accessible for first-time buyers. Jeremy Hunt might have scrapped the 99% mortgage scheme, but that hasn’t stopped one lender from releasing their own 99% loan-to-value product. It could allow buyers to secure ...

Buy to Let Business | The Complete Guide

Being a landlord can be a very lucrative business. Even when the property market struggles, long-term investment in property has shown itself historically to be a stable venture. Plus, it can become a flexible and scalable business enterprise. With a range of advantages, from tax benefits through ...

How to Calculate Business Profit

Profit - the primary way of seeing whether your company is successful (making a profit), or struggling (not making a profit). But how do you truly calculate profit, what does it mean, and what are the impacts on your business planning? Join us as we dive into exactly how to calculate profit. ...

How to Switch to a Buy to Let Mortgage

Switching to a buy to let from a residential mortgage can be daunting, especially if you’re unsure if you’ll pay any early repayment charges or mortgage set-up fees. But if it can unlock the rental potential of your current residential property and help fund your ambitions to move or go...

How Do Mortgage Interest Rates Work?

Your mortgage interest rate is one of the most important factors to consider when buying a home - so how does it work? Interest is charged on every pound you borrow, so the higher the rate, the more you’ll pay back. With this in mind, it’s a good idea to understand the different types ...

How To Get A Mortgage For A Grade 2 Listed House

If you are looking for a mortgage or short-term finance for a grade 2 listed home, you may come up against a few challenges in finding a lender who will consider this type of property. When you hear the phrase ‘listed building’, you might think of a stately home or some other grand stru...

Credit for Businesses | The 13 Best Options Compared

Every business needs money to run, more money to stabilise, and even more money to expand and succeed. While a simplistic model of self-sustainability may work for micro businesses, for enterprises designed to thrive, it's necessary to look to support from the financial service industry. In short, ...

A Full Guide To Financing Your Next Property Renovation: Refurbishment Bridging Loans

Whether you're an established developer with a large property portfolio or a first-time investor just getting into property investment, refurbishment finance can be an extremely useful tool to help you take advantage of those golden opportunities that come your way. So, what is refurbishment f...

How To Get A Renovation Mortgage

A renovation mortgage is designed to help property owners finance the cost of renovating or remodelling their property. Whether you're a first-time buyer, a property developer, or anywhere in between, choosing the right finance for buying a renovation property is as important as choosing the d...

Bank of England Holding Base Rate at 5.25%: What it Means for Your Mortgage

Financial experts generally agree on one thing: that the base rate will drop in 2024. However, property owners want to know when they will see a drop in interest rates. The Monetary Policy Committee is responsible for setting the bank rate. In their most recent meeting on March 21s...

Should You Get a Tracker or Fixed Rate Mortgage in 2024?

The Bank of England has announced that it's keeping base rate at 5.25%. We're taking a snapshot of the best rates available on the market today for fixed and tracker mortgage products and see how they compare. With higher interest rates driving up costs, many are asking what this means for our mort...

What is Cash Flow in Business

Simply put, cash flow is the movement of cash into and out of your business. Cash in represents payments you take from clients and customers, and cash out is the money you spend on running your business. When cash in is larger than cash out, then you have positive cash flow, and your business is gr...

Small Business Loans UK - 5 Things To Know

Statistics published by the UK government at the tail end of 2023 show that out of the 5.6 million private sector businesses in the country, 5.51 million of them are classed as ‘small businesses’, meaning they have less than 50 employees. Given that 95.4% of private sector companies are...

Can I Remortgage Early On A Fixed Rate?

There are many reasons you may be asking, "Can I remortgage early?" - from releasing equity to securing better interest rates. But there are a few obstacles you may need to overcome if you want to exit your mortgage deal before it's finished. You're considering switching your mortgage deal but are ...

How to Get Refurbishment Finance for a Buy to Let Property

Buy to let refurbishment finance can empower you to take advantage of investment opportunities by providing funding quickly. You've spotted a fixer-upper that could generate handsome rental income with some TLC. Projects like this can offer huge ROI, but it can be difficult to get a mortgage fo...

Can I Remortgage If I Own My House Outright?

You may wonder if you can remortgage your house if you own it outright. When you own an unencumbered (mortgage-free) property, you can use its value as security for a new mortgage and release some of the capital locked up in it. An unencumbered remortgage will give you access to a lum...

Government Start Up Loans

One of the questions that many people considering starting a new business ask is: ‘what financial help is there?’ Thankfully, the answer to that is: ‘lots’. In the UK, one of the first places people might like to consider looking is to the government itself, in the form of ...

How to Get a Limited Company Buy to Let Mortgage

Is it better to buy a buy to let property through a limited company or special purchase vehicle (SPV)? Whether you're buying your first investment property, or are an established private landlord, the tax benefits of mortgaging your property through a limited company can be sig...

How To remortgage A Buy To Let Property

You may be considering if the time is right to remortgage your buy to let property. You could find a better deal or release some equity for further property investment. Here we explore why you might want to remortgage a buy-to-let property (BTL), what considerations you need to make,...

What Is A Buy To Let Mortgage Stress Test And Will I Pass It?

A buy to let stress test is a process that most landlords go through when purchasing a property to rent. But how is it used, and how does it affect your mortgage eligibility? The stress income cover ratio (SICR) is the calculation lenders apply to determine your affordability of a buy to let (BTL) ...

How to Secure a Land Mortgage in 2024

We explore the intricacies of securing a land mortgage in 2024, providing expert insights and tips to help you navigate the process with confidence. What is a Land Mortgage? Land mortgages are specialised loans designed for purchasing land. They differ from standard residential mortgages due to th...

Bridge to Let Loans: What You Need to Know

Bridge to let loans are flexible finance solutions for buy to let and investment properties. In many circumstances, they can empower you to act like a cash buyer if you are experiencing a short-term funding gap. These loans are most commonly used when: You don't have the cash to hand and need fu...

Can My Mortgage Be Used To Pay Stamp Duty?

When buying a home, getting caught out by a higher Stamp Duty tax bill than you expect is the last thing you need. If you can’t afford it, it could mean reducing the deposit you can put down or needing a larger loan, which can reset your lender’s mortgage calculators and leave you with ...

2024 Spring Budget - What it Means for SMEs

Cuts to National Insurance, an increased VAT threshold, and frozen alcohol duty—will these help businesses in the cost-of-living crisis? Chancellor Jeremy Hunt’s Spring Budget has indeed been wrought with controversy since its announcement on Wednesday. The primary change that has...

Spring Budget 2024: 5 Key Takeaways for the Property Market

Property owners are left wondering what to expect after the Chancellor proposed changes to short-term lets, capital gains tax, and the non-domicile status. Chancellor Jeremy Hunt announced in his Spring Budget that the government plans to scrap multiple dwellings relief and the furnished holi...

How to Value a Business

Understanding the worth of your business is a complicated calculation that may not have been considered in some time. When a situation arises where the financial value of your business is needed, it is often necessary to calculate the value from scratch. But how do you go about making a business va...

NEWS: Best Place to Invest in Property 2024 Revealed

High rental demand and growing property prices – here's why Bristol is the UK’s newest buy to let hotspot According to Aldermore’s Buy to Let Tracker, Bristol has been named the Best City for Property Investment in 2024. The decision is based on five key factors: average ren...

Is Now the Time to Switch? Major Lender Offers New 5-year Fix with No ERCS

Mortgage rates are at their lowest since 2021, but consumers are stumped over whether now is the time to commit to a new deal. A major lender has released an innovative new product allowing customers the ability to lock in the market’s current rates, but flexibility to switch prod...

The 9 Best Places to Live in the UK | 2024

Moving to the UK? We've put together a list of the best places to live in the UK if you're an expat or foreign national, rated for affordability, lifestyle, work opportunities and overall happiness. Moving to a new country is a monumental decision that opens the door to fresh experiences, dif...

Buying a House in the UK From Abroad

There are a lot of myths and misconceptions about buying a house in the UK from abroad. Is it possible? The answer is a resounding YES. You might be a foreign national looking to invest in the UK property market or an expat looking to return to the UK. Either way, it's important to know that there ...

Home Improvement Loans - The 7 Best Options

You’re looking to refurbish your property, but you need funding – here are the seven best home improvement loans for your next project. The time has come for you to redecorate. Whether you’re a homeowner tired of looking at an old kitchen or a landlord replacing a leak...

Revolving Credit Facility | The Best Options Compared

A revolving credit facility, sometimes called a “line of credit”, is one of the more powerful tools available to businesses looking to manage their cashflow, but how does it work and what makes it different to the other types of business finance? More importantly - how can you use a revo...

How to Get a Skilled Worker Mortgage

You may be wondering if you can buy a house in the UK on a skilled worker visa - and the answer is a resounding yes! There are some additional challenges, but it is very much possible with the right lender. A Skilled Worker Visa (also known as the Tier 2 visa before Decembe...

Interest Only Vs Repayment Mortgage: Which Is Best?

Making a decision between an interest-only or repayment mortgage is an important financial decision. Here, we look at the key differences between these mortgage products and how a specialist mortgage advisor can help you choose the right mortgage for you and your circumstances. When ...

How To Refinance a Property in the UK

It's common to refinance a property during your mortgage term. Over time, interest rates will fluctuate, and you will build up equity in your property, allowing you to switch to more advantageous products. The average mortgage term is 30 years, but you won't typically be on the same mortgage deal f...

How Do Business Loans Work?

You know that you need capital for your business, you know that you can get a loan to help, and you know that it means having to pay back money over time, but really, how do business loans work? At Clifton Private Finance, we’re here to tell you. How Business Loans Work - The Bas...

Supply Chain Finance

Managing cashflow is an important aspect for any business, but it is rare that you truly consider your supplier’s cashflow - after all, someone else’s business is their business, right? This approach can be somewhat shortsighted, however. Making an assumption that they’re in a bet...

Franchise Finance

Opening a franchise is a secure way to own a business - and more importantly, a profitable business. Statistics published in a 2018 joint report between the British Finance Association (BFA) and NatWest, show that 93% of franchises were considered profitable in 2018. While those figures (the lates...

The Beginner's Guide to Construction Loans

Development finance lenders exist to provide construction loans to individuals and companies to make the best return possible over the shortest space of time, at the least possible risk. It's their raison d'être. On the other hand, you have a terrific development opportun...

Asset Based Finance | Everything You Need To Know

For many businesses, asset-based finance is the best solution for capital needs. But what does an asset-based secured loan actually entail? At Clifton Private Finance, we have the answers. And while you're here, if you want to speak to a specialist about your options - whether that's asset-bas...

Mortgages for Doctors - Finance for Medical Professionals

Mortgages for doctors are not as straightforward as you may not expect. Doctors and medical professionals face particular challenges when applying for a mortgage. But with the help of a specialist broker, there are some highly favourable terms available to you. We’ll show you how to ma...

Living In Dubai? 4 Ways to get a UK Expat Mortgage

If you're a British national looking to get a UK expat mortgage from Dubai, you may be wondering what's available for you. There are a variety of reasons you may want to purchase a property back home. It might be an investment, or you may be planning on returning to the UK. But you've pr...

News: UK’s Top Ten Rental Yield Hotspots for Landlords

Where are the best places in the UK to invest in property? We explore the Top 10 Rental Yield Hotspots for landlords, touching on the current rental landscape in Britain and what makes these areas, in particular, so great to invest in. Despite occasional fluctuations, demand for property in the UK ...

How To Get A Mortgage On A UK Property If You Live In Australia

Getting a UK mortgage can be challenging if you live in Australia. Australian residents will face scrutiny when applying for an international mortgage in the UK- but there are ways to make the process smoother. This article explores the options available to you as an Australian resident and th...

Applying for Retrospective Planning Permission: Is it Worth the Risk?

Retrospective planning permission is a common occurrence in the property development world. You may have made an honest mistake during building works and only realised afterwards you need permission. Or you may have discovered you can’t sell your house unless it matches the land registry recor...

My House Has Gone Up In Value: Can I remortgage?

One of the most common reasons homeowners choose to remortgage is because the value of their house has increased. If you have more equity in your home than when you first took out your mortgage, you can remortgage to get a better deal with lower rates. Or, you may be able t...

Invoice Factoring vs Discounting

Invoice discounting vs factoring is a common debate for businesses small and large looking to raise finance against their unpaid invoices. Invoice finance itself represents a way for your business to weather the storm of invoicing terms - that 30-day or longer period between sending out an invoice ...

A Guide to Bank Statements When Applying for a Mortgage

Whether you’re applying for a first time buyer mortgage, a buy to let mortgage, a development loan or any other type of property finance, you’ll need to provide your recent bank statements to your mortgage lender. In this guide, we look at why mortgage lenders ask for your bank sta...

Guide to Innovation Grants

Innovation grants are a fantastic way for businesses that undertake new scientific or technological developments to get funding. The path to obtaining an innovation grant is not an easy one but the reward is well worth the effort. At Clifton Private Finance, our team are dedicated to helping your ...

5 Ways To Get Into UK Property Development For The First Time

When you apply for development finance, lenders will typically put a lot of weight on the success of your past projects, making it notoriously tricky to get into UK property development for the first time. You’re ready to join the 2.5 million property investors in the UK and start building yo...

Are Bridging Loans a Good Idea?

Bridging finance has become a popular funding solution in the last decade, but are bridging loans a good idea? A bridging loan can be a good idea depending on what kind of property finance you need, for how long, and whether you have a solid exit strategy in place. In this guide, we explain what b...

What Is Trade Credit & How Does It Work?

Businesses whose primary customers are other businesses (known as business-to-business or B2B companies) typically engage in an arrangement of trade credit. Whether formal or informal, this system allows for work to flow between companies without being stifled by cash flow issues or administrative ...

Startup Funding | The 5 Best Options

Startup funding can be a bottleneck hurdle for an already complicated process - starting a new business. Turning your lofty dreams of business ownership into a reality needs a combination of determination, perseverance and, most importantly, capital. Raising the money needed for yo...

Invoice Discounting | 7 Advantages And Disadvantages

Invoice discounting is one of the two main types of invoice finance available for companies to leverage their accounts receivable and release funds early, but what exactly does invoice discounting do for you and is it right for your business? Let’s look in-depth at the pros and cons of in...

Factoring Companies | Comparing Invoice Factoring Options

Factoring companies can help you solve one of the biggest problems for businesses in the UK: cash flow. When cash flow is good and there's a comfortable positive bank balance, it's possible to invest in the future and grow the company. If a business struggles with cash flow, however, it can feel ch...

Remortgaging as a UK Expat - The Comprehensive Guide

If you're living overseas, remortgaging as a UK expat isn't as complex as you might think. But remortgaging with a high street lender may not be the most cost-efficient route to take. There are many reasons you may want to remortgage your property while living overseas. Some of these include...

NEWS: A Guide to the Most Expensive Streets in the UK

Are you dreaming of living on one of the most expensive streets in the UK? Or perhaps you're just curious about what makes a truly prime property location? In this post, we take a tour of the streets with the highest average property prices in each area of the UK, according to recent data...

100% Bridging Loan | How it Works

If you're looking for a bridging loan to cover the total amount of a property's value – you'll need a 100% bridging loan, or 100% LTV (Loan-To-Value) bridging loan. This means you don't need to put down any deposit for your bridging loan, and can borrow the full value of the property yo...

Get a Bridging Loan to Buy and Renovate a Property to Sell

Thinking of buying a property to renovate and sell? House flipping can be lucrative, but funding these projects can be an issue. Bridging loans can offer a fast and flexible solution. If you’ve found a property that offers scope for you to refurbish and sell at a profit but don't have y...

How to Finance a Barn Conversion Using a Bridging Loan

Barn conversions have been a popular way to create stunning rural homes full of character for many years, but as with any conversion of a non-residential building, funding can be an issue. You may not be able to get a mortgage for these builds, but a bridging loan could finance your barn conversion ...

How to Use a Bridging Loan to Buy a House in London

Getting on the property ladder in the capital can be challenging - but did you know you could use a bridging loan to buy a house in London? The London property market is notoriously competitive, so when you find the perfect home, you need to move fast - this is where bridging finance comes in....

Changes to R&D Tax Credits In The 2023 Autumn Budget

If you run an innovative business, you'll likely have come across the UK government's Research and Development (R&D) Tax Credits scheme. This programme has been providing valuable support to companies undertaking important R&D work for over 20 years now. However, we’ve noticed a lack ...

How To Get A Bridging Loan To Buy, Refurbish And Sell A House

Property flipping can provide healthy returns if done correctly. If you've found a 'fixer-upper', you could use a bridging loan to refurbish and sell it. Unless you have a significant amount of cash at your disposal, you will likely need to borrow finance to fund the purchase and ren...

Unlocking Opportunities with 100% Development Finance

100% development finance can play a pivotal role in bringing ambitious property projects to life. It can provide the necessary capital for developers to acquire land and finance construction. Is it possible to find a lender willing to finance 100% development costs? Yes, but only if y...

How To Get A Bridging Loan In Scotland

Acting quickly is essential to closing deals in Scotland's property market, and bridging finance can help - but is it easy to get a bridging loan in Scotland? Whether you're looking to buy Scottish property for commercial or residential purposes, having fast finance in place will save you from...

Day Rate Mortgage - How to Borrow at Your Daily Rate

As a contractor or freelancer in the UK, your income situation can make getting a mortgage more difficult than if you were a permanent employee. This is especially true if you are compensated on a day rate basis. While your daily or hourly contract rate may be high, limited company complexities mea...

Can I Get A Bridging Loan To Pay Inheritance Tax?

Yes - it's common to use bridging finance to pay inheritance tax before it is due. In fact, using short-term finance can be a convenient means to handle some of the administrative issues that make managing probate so difficult. One of the common issues that can arise during this process is that the...

How much does a bridging loan cost?

Bridging loans typically cost 1-2% of your loan size, charged as an arrangement fee by your lender. You also usually pay: A monthly interest rate Valuation or survey fees Legal fees Broker fees Other admin fees, such as drawdown and redemption fees This might seem like a l...

Understanding Business Loan Interest Rates

Almost every business loan comes with interest - it’s one of the key costs to consider when taking out a loan. But it can be difficult to know when you’re getting a good deal on your business loan interest rate. Your interest rate is how much it costs to borrow from a lender. Your...

Should I Use An Expat Mortgage Broker Or Go Directly To A Lender?

If you’re an expat looking to purchase or remortgage a property in the UK, a common question is whether it’s best to secure your expat mortgage directly through a lender or approach an expat mortgage broker. Although you’ll ultimately have to speak to a specialist expat lender reg...

NEWS: Research Reveals Insights into UK Mortgage and Property Market in 2024

Our recent survey results provide insight into public perceptions regarding interest rates, mortgage repayments, house prices, and the housing crisis debate in the UK in 2024. About Clifton Private Finance: Clifton Private Finance specialises in mortgage brokering and property finance, o...

How to get development exit finance as your building project nears completion

When a property development project is coming towards the end of its agreed term of finance, unexpected delays in finishing the build or finalising sales can have a major impact on the cost of your finances and the profitability of your development. Development exit finance wins on three counts...

How to use a bridging loan to buy a house before selling your current home

In an ideal world, we'd all wait to sell our old house before buying a new home. But in reality, it's not always possible: the market may be slow, a buyer may have dropped out, or you might want to do renovations before moving in. Short-term borrowing allows a financially-aware buyer t...

How To Get A UK Mortgage When Living And Working Abroad

It's certainly possible to get a UK mortgage while living abroad, but applying for a UK mortgage as an expat can be difficult because being based overseas makes it that bit harder for lenders to establish your earnings and check your credit history. You may find that you need to give your credit sc...

How to get a UK expat mortgage

How does a UK expat mortgage differ from a standard UK resident mortgage? We cover some of the challenges British expats commonly face when seeking UK property finance and what to expect if you decide to return to Britain. It's true that applying for a UK mortgage as an expat can be more compl...

How To Get A UK Mortgage With A Foreign Income

Whether you're working abroad with aims to return to the UK, or you're a British resident earning in a non-sterling currency, getting a UK mortgage with a foreign income can come with its challenges. Many high street banks will shy away from borrowers on a foreign income. Still, whether you're...

A Guide To Bridging Loan Interest Rates

Many understand the interest rates associated with traditional mortgages – yet, bridging loan interest rates and how they work can vary significantly. Short term property finance, namely bridge loans, are an excellent way to finance property and are often best suited to circumstances that dem...

Business Loans For Limited Companies

If you're the director of a limited company, you may need access to a loan to boost the growth of your business or support your cash flow when times are tough. Limited company loans are a specialist type of business finance available to help limited companies. As a limited compa...

What Are DSCR Loans and How Do They Work?

DSCR loans are becoming increasingly popular in today's market. Instead of using your credit history, your eligibility for a DSCR loan is calculated using the projected income of the assets you'll be purchasing with the loan. Lenders and investors constantly seek to mitigate risk. For this reason, ...

A Guide to Tractor Finance

For most farms, tractors are an essential part of daily life. Tractor finance is borne from the need to use specialist agricultural machinery like this, even when access to capital is low. Getting quality agricultural machinery is important to keep your farm or agricultural business running. ...

Getting An Airbnb Mortgage: Everything You Need to Know

Since Airbnb first gained traction in the UK in 2015, it has become an increasingly lucrative way to rent property. But while the returns for this type of rental are high, securing an Airbnb mortgage isn't as straightforward as you might think. The Airbnb market is continuing to grow througho...

HMO Mortgages – How To Finance An HMO Property

HMOs are still proving to be a lucrative investment today, but if you're looking to secure finance, expect different lending options for an HMO mortgage. The ROI returns can be impressive, but only a few specialised intermediary-only lenders will fund a foray into the multi-let market. If you've p...

7 Ways to Get a Business Loan in the UK

When looking at getting a UK business loan, there are many things to consider. With a wide range of products and an even wider range of lenders in the marketplace, it can be the work of ages just to sift through them. At Clifton Private Finance, we have a team of experts ready to help you fin...

NEWS: No Deposit Mortgage Now Available – Is It Worth It?

A major lender has launched a no deposit mortgage that lets first-time buyers get a 100% LTV mortgage (loan to value). The minimum deposit is usually 5% for first-time buyers. So, what makes this mortgage different? Is there a catch? And what will the interest rate be? // Here’s wha...

Can I Get A Mortgage For 5 Or 6 Times My Salary?

There ARE "5x, 5.5x and even 6x" salary mortgages out there, offering maximum borrowings on your earnings. How can you get your hands on one of them? It’s not just hard-pressed first-time buyers who need to maximise their salaries' borrowing potential to get a toe-hold on the property ladder....

NEWS: Will House Prices Drop in the UK in 2024?

The average home price has dropped by over 3% since October 2022, with experts predicting further reductions in 2024. House prices were rising until October 2022 and then followed a series of monthly drops in the property market throughout 2023, according to Nationwide's house price inde...

.png)

.jpg)